A great fall: The bitcoin inflation rate provides a flattering view of the cryptocurrency's stability

“When I use a word," Humpty Dumpty said, in rather a scornful tone, "it means just what I choose it to mean – neither more nor less.”

This passage by Lewis Carroll, taken from an exchange between Alice and Humpty Dumpty in Through the Looking Glass, may sound absurd.

Yet it is strangely relevant to today’s bitcoin markets.

One explanation for the value of bitcoin is its supposed anti-inflationary properties. Unlike conventional currencies, the ultimate supply is limited by design to 21 million coins.

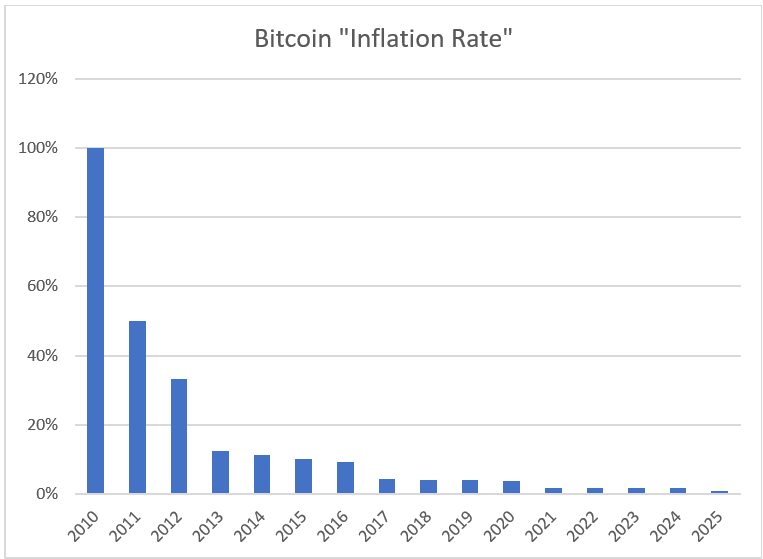

What is the bitcoin inflation rate?

The rate at which new bitcoins are created halves every four years.

Originally the reward to bitcoin ‘miners’ for validating a block of transactions was 50 new bitcoins. Currently the reward after a succession of ‘halvings’ is 3.125 bitcoins.

The rate at which the bitcoin supply increases is described by cryptocurrency enthusiasts as the ‘bitcoin inflation rate’.

The low and falling bitcoin inflation rate is quoted as yet another reason for the superiority of bitcoin over ‘fiat’ currencies such as the US dollar, which are not pegged to the price of gold or silver.

Liam Wright, editor-in-chief of Cryptoslate, wrote in Forbes that: “The current inflation rate for bitcoin stands around 0.84 per cent, whereas the most recent US inflation data for May came in at 3.4 per cent.”

Why bitcoin enthusiasts are misusing the word inflation

The problem with this story is that it depends on a Humpty Dumpty-like misuse of the word of inflation.

To quote the International Monetary Fund (IMF), the standard economic definition of inflation is “the rate of increase in prices over a given period of time.”

This is measured by looking at the changes over time in the cost of buying a standard basket of goods.

Inflation is not a measure of the change in the amount of money in circulation. So-called ‘bitcoin inflation’ measures a change in supply rather than a change in value.

While in conventional currencies, changes in the money supply are related to changes in the inflation rate, they are not the same thing and other factors influence the extent to which a change in the money supply leads to change in the inflation rate.

The economic inflation rate of bitcoin

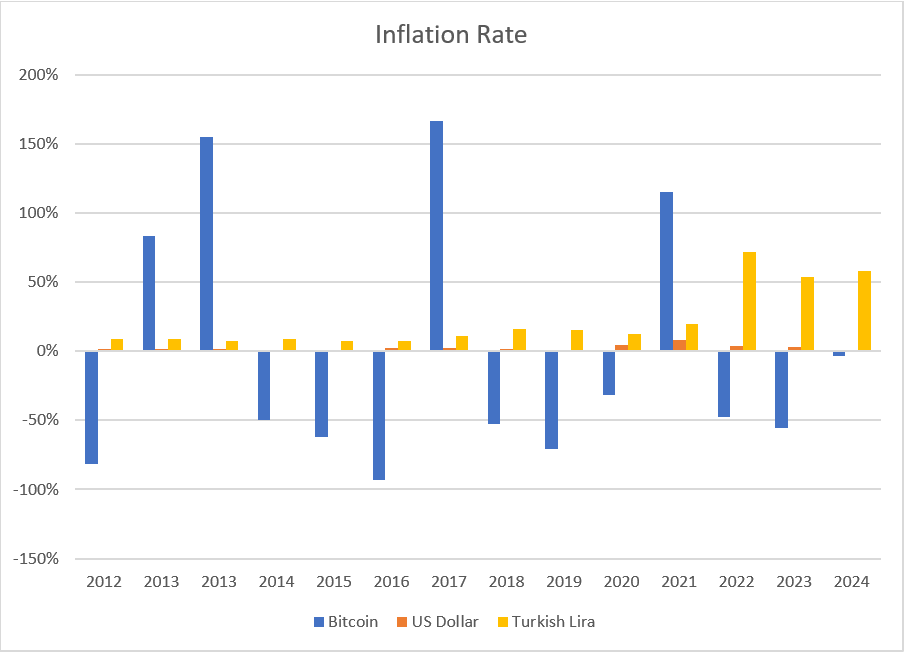

So, what is the real inflation rate for bitcoin using the normal economic definition?

Given the lack of bitcoin usage in real world commerce, it is impossible to simply find a representative basket of conventional goods regularly purchased with bitcoin and look at how the price level fluctuates over a period of time.

Even in El Salvador, where bitcoin was, for a period, given official status it was little used in day-to-day commerce.

The alternative is simply to look at the change in the value of bitcoin in dollar terms over the course of the year and adjust the rate of change by the US dollar inflation rate. This gives the change in the cost of a standard basket of goods in the US in bitcoin.

The calculation does not show a steadily falling rate of inflation for bitcoin. Instead, it shows a wildly yo-yoing inflation rate as the bitcoin price periodically surges and collapses.

Over a 12-year period the true annual bitcoin inflation rate varied between 166 per cent (hyper-inflation) and minus 93 per cent (hyper-deflation).

Hyper-inflation in terms of bitcoin (when the bitcoin price periodically collapses) is not unique to bitcoin.

Multiple fiat currencies have experienced similar rates, often to the point it completely destroys the value of the currency.

The chart below shows the inflation rates for the US dollar over the same period (consistently low apart from 2021) and for the Turkish Lira, which has experienced persistent high inflation.

How stable is the value of bitcoin?

Hyper-deflation (the result of each bitcoin bubble) is unique to cryptocurrencies.

From an economic perspective, a currency is most useful when its value remains relatively stable. Price stability removes a great deal of the friction in commerce, investing, and financial planning by firms and households.

A currency with a wildly unstable value (up and down) is as unsuitable as a currency that suffers from consistently high inflation.

Even on the Dark Web, Ross Ulbricht, aka “Dread Pirate Roberts”, found himself having to provide insurance against the wild movements in the value of bitcoin to his customers on his illegal marketplace Silk Road before he was arrested in 2013.

An article in Forbes magazine reported that: “To insulate those sellers against bitcoin fluctuations, the eBay-like drug site also offers a hedging service.

“Sales are held in escrow until buyers receive their orders via mail, and vendors are given the choice to turn on a setting that pegs the escrow's value to the dollar, with Silk Road itself covering any losses or taking any gains from bitcoin's swings in value that occur while the drugs are in transit.”

The annualised inflation rate for bitcoin actually provides an overly flattering view of the stability of its value, since bitcoin and the other cryptocurrencies have suffered much wilder fluctuations over the course of months or even days.

The price of bitcoin has grown spectacularly since its creation, but the arguments that its value derives from its anti-inflationary properties are simply down to an incorrect use of the word “inflation”.

This article was originally published by Finextra as part of its regular series of insights by authors from the Gillmore Centre for Financial Technology at Warwick Business School.

Further reading:

Are cryptocurrencies any closer to ending central banks' control?

Do digital currency projects have public buy-in?

How do we keep stablecoins stable?

Why the UK needs to create a fintech ecosystem

Martin Walker is an Honorary Research Fellow at the Gillmore Centre for Financial Technology at Warwick Business School and a Fellow at the Centre for Evidence-Based Management.

Learn more about the new MSc Financial Technology developed by the Gillmore Centre.

Discover more on Fintech and Markets. Subscribe to up to the Core Insights newsletter via email and LinkedIn.

X

X Facebook

Facebook LinkedIn

LinkedIn YouTube

YouTube Instagram

Instagram Tiktok

Tiktok