Cap gun: By September 2017 the market capitalisation of Bitcoin was about $65 billion, the equivalent of a large cap stock

- Study tracked the 14 largest cryptocurrencies over 18 months

- Bitcoin made up more than 80 per cent of traded volume up to early 2017

- Market capitalisation of Bitcoin alone was £65 billion by Spetember 2017

- Cryptocurrencies market looks similar to the dot.com bubble

New research has found cryptocurrency prices are not influenced by any economic factors and instead are driven purely by the mood swing of investors.

The stunning rise in the price of Bitcoin, hitting $17,500 last December as it increased by more than 500 per cent in 2017, has seen investors flood to cryptocurrencies with futures markets even being set up by exchanges.

But new research studying the weekly trading patterns of 14 of the largest cryptocurrencies, including Bitcoin, from April 2016 to September 2017 found no correlation with any economic indicators that investors would base decisions on or with commodities.

Instead, in a working paper entitled Cryptocurrencies as an Asset Class: An Empirical Assessment, Daniele Bianchi, of Warwick Business School, the researcher concluded that pricing is entirely influenced by past returns, and the hype and emotion of investors as they watch the price climb or drop.

“There is research showing limited similarities between Bitcoin and gold, but looking across the 14 biggest cryptocurrencies the high volatility of their price means that they can hardly be seen as a reliable savings instrument in the short-term, let alone the long or medium term,” said Dr Bianchi.

“These are not like normal currencies where a country’s economy will influence the price. Instead, they share similarities to investing in an equity from a high-tech firm. As a matter of fact, most of these cryptocurrencies come to existence through unregulated crowd sales similar to IPOs, the so-called Initial Coin Offering.

“As a result, the market for cryptocurrencies may look similar to the dot.com bubble at the end of the 1990s, and it may be that only a handful of them survive, so for investors it is like choosing who will be today’s Amazon.”

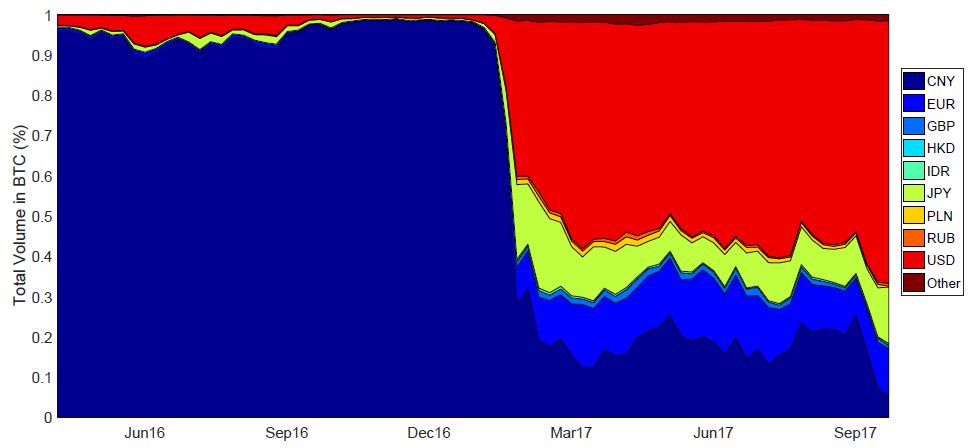

Despite the vast number of cryptocurrencies being produced, Dr Bianchi found transactions in Bitcoin made up more than 80 per cent of the overall traded volume before early 2017, then declined to about 40 per cent towards the end of the sample period in September 2017.

What influences the price of Bitcoin and cryptocurrencies?

Indeed, by September 2017 the market capitalisation of Bitcoin and Ethereum alone was about $65 billion and $28 billion, respectively.

That is the size of a large cap stock in the US yet the end-of-sample median market capitalisation across the 14 cryptocurrencies, which made up 85 per cent of the total market capitalisation of cryptos, was about $850 million, which is more the size of a small cap stock.

The study also found that up to early 2017 almost all of the trading in Bitcoin was done in Chinese Yuan before the Chinese Government embarked on shutting down the exchange platforms (see chart below).

Dr Bianchi added: “Although the market for cryptocurrencies is growing massively, it is still largely dominated by a few players.

“Cryptocurrencies have more in common with an equity investment in a company than an investment in a traditional currency. For instance, holding Bitcoin can ultimately be seen as an investment in the blockchain technology rather than a simple speculation.

“Having said that, portfolio returns are highly volatile, thus negating the chances of using the popular momentum strategy for trading in cryptocurrencies. Although there is some predictive power of past performance for future returns, the profitability of a momentum strategy in cryptocurrency markets is significant only in the very short term.”

Further reading:

How should governments regulate stablecoins and cryptocurrency?

Are cryptocurrencies any closer to ending central banks' control?

How do we keep stablecoins stable?

Daniele Bianchi is Assistant Professor of Finance and teaches Empirical Finance on the MSc Finance.

For more articles on Finance and Markets sign up to the Core Insights.

X

X Facebook

Facebook LinkedIn

LinkedIn YouTube

YouTube Instagram

Instagram Tiktok

Tiktok