The coronavirus outbreak has created clear winners in businesses such as Amazon, Facebook, Netflix, Google and Apple, and losers such as Uber, Airbnb, and WeWork.

The vast majority of industries are losers as they are effectively shut by the lockdown.Taxi usage has collapsed which means it may be a long time before Uber approaches break-even.

People have stopped booking holidays and accommodation so Airbnb’s revenue stream is disappearing fast along with hopes for an initial public offering. Thus, major cost saving initiatives are in progress at the San Francisco-based online home rental firm.

Temporary office working has also largely disappeared as people are required to work from home. They may find working from home is effective and not return in the droves which WeWork, the trendy office rental firm still reeling from losing its CEO and founder Adam Neumann in September 2019, needs to break even.

Among the losers availability of cash is absolutely key. Those without cash or only limited availability of credit have a major problem. In the cases of ride-hailing app Uber, Airbnb, and WeWork they appear to have enough cash to last up to a year or thereabouts.

This means they have time to refinance the business. Although SoftBank, the giant Japanese telecoms and technology conglomerate, is attempting to avoid contributing a promised $3 billion to WeWork.

Many businesses, however, simply do not have access to adequate cash or credit lines and will disappear during the next six months, only the strongest will survive. Unless there is significant government underwriting of bank debt many loans will be foreclosed. Banks will not be keen to increase their exposure.

Coronavirus webinar: Design thinking for radical change and innovation

There are plenty of measures which business can take to preserve cash. Firstly, do not pay dividends or buy back shares, defer any acquisitions in progress, and put major projects on hold.

Furlough all employees who are not fully occupied (in the UK this is helped by a Government measure whereby it will pay 80 per cent of employees' pay when not required as a consequence of the virus), temporarily reduce salaries of the rest of your staff and defer as many payments you can.

Firms also need to keep communications open with the bank as they will need their support. Despite these measures affected businesses will continue to build debt or fail to pay creditors while the lockdown continues. Thus, businesses already encumbered with significant debt may fail the insolvency test or arrive at the point when it is clear the increased debt will never be repaid.

Two principal industries that will be major sufferers as creditors to bankrupt companies are the property industry and banking. Rents are unlikely to be paid, bank loans will default, suppliers more generally will have a hard time as customers are unable or unwilling to pay for supplies as they conserve cash. In some cases this is deferral in others the debt will never be paid.

This rapid and vast attrition of business will have a whole series of consequences. Firstly, many businesses carry significant debt as this has been a low-cost means of financing.

What should firms do in the pandemic?

Private equity uses debt extensively, and activist investors pressurise boards into increasing cheap borrowing and distributing cash to shareholders. Both are concerned with efficient, low-cost financing structures, which increases risk.

Activists believe that boards who retain large amounts of cash have a tendency to waste much of it on inappropriate acquisitions and ill-advised diversifications. The consequence of high debt is that many of these businesses will now be severely troubled.

Private equity has $2.5 trillion of cash at its disposal, so they can rescue their controlled businesses if they so wish. One suspects that they will be selective in choosing which to save.

This will clearly dent their returns in that some will be refinanced while others will be allowed to fall into the hands of creditors. Private equity will also be looking for bargains as prices for available businesses collapse. There will be many good businesses encumbered with too much debt that can be bought out of receivership.

Another consequence is that debt is likely to be used more sparingly in future as a means to finance business. Banks will suffer much of the adverse consequences and will reduce lending and reprice risk to private equity companies in particular.

After the epidemic there will be far fewer businesses competing as a consequence of the virus lockdown. Consumer choice will be reduced, and prices may increase.

Certainly, where industry entry barriers are high, as is the case with Amazon, Facebook, Google, Apple and Netflix, then the incumbents will benefit with even less competition.

In other industries such as air travel, retail, restaurants, construction, taxi ride-hailing, temporary office rental and many others where entry barriers are much lower, then new competitors are likely to emerge in time.

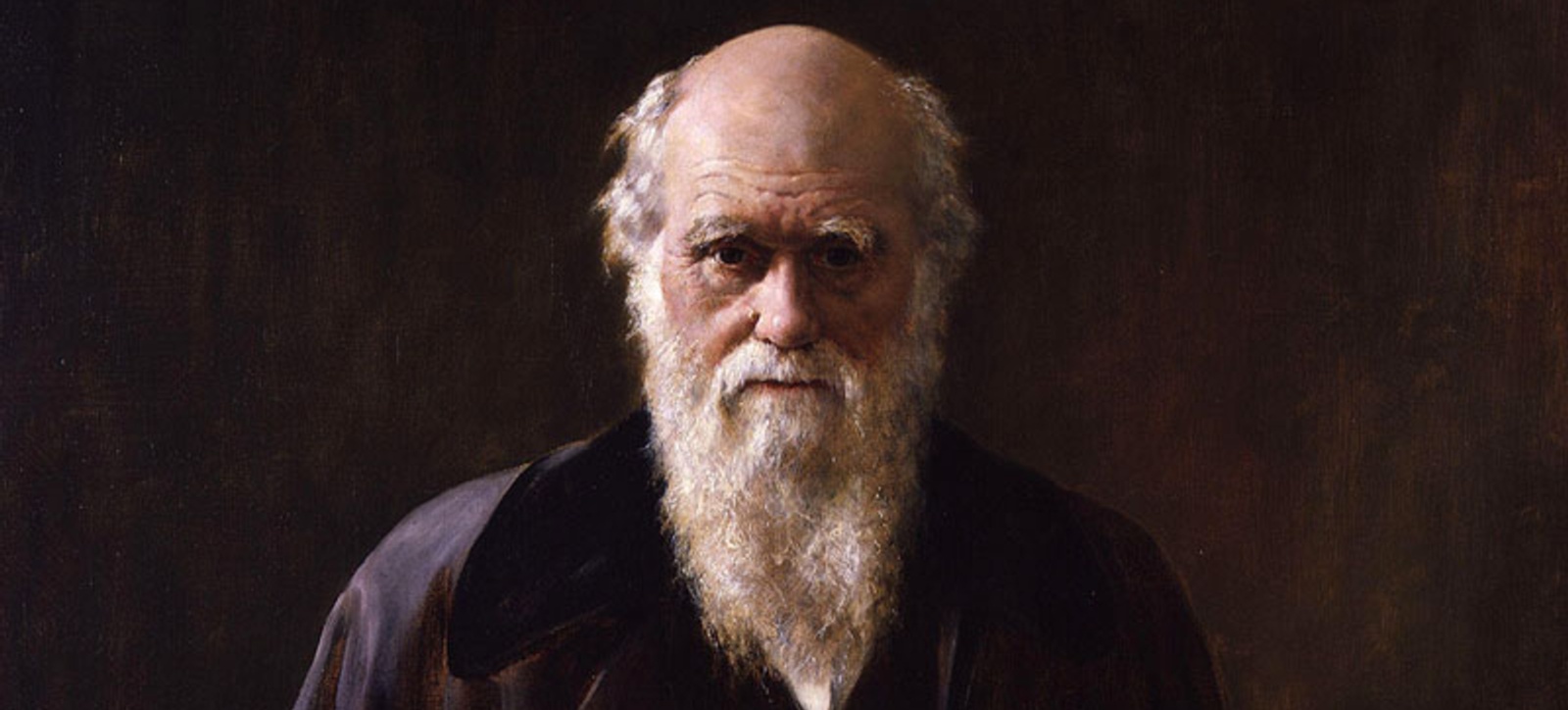

In effect this is Darwinist survival of the fittest compressed into six months. Business will not be the same again.

John Colley is Professor of Practice in Strategy and Leadership and teaches Mergers and Acquisitions on the Executive MBA, Executive MBA (London) and Distance Learning MBA. He also lectures on Strategic Thinking on the Full-time MBA.

For more articles like this download Core magazine here.

X

X Facebook

Facebook LinkedIn

LinkedIn YouTube

YouTube Instagram

Instagram Tiktok

Tiktok