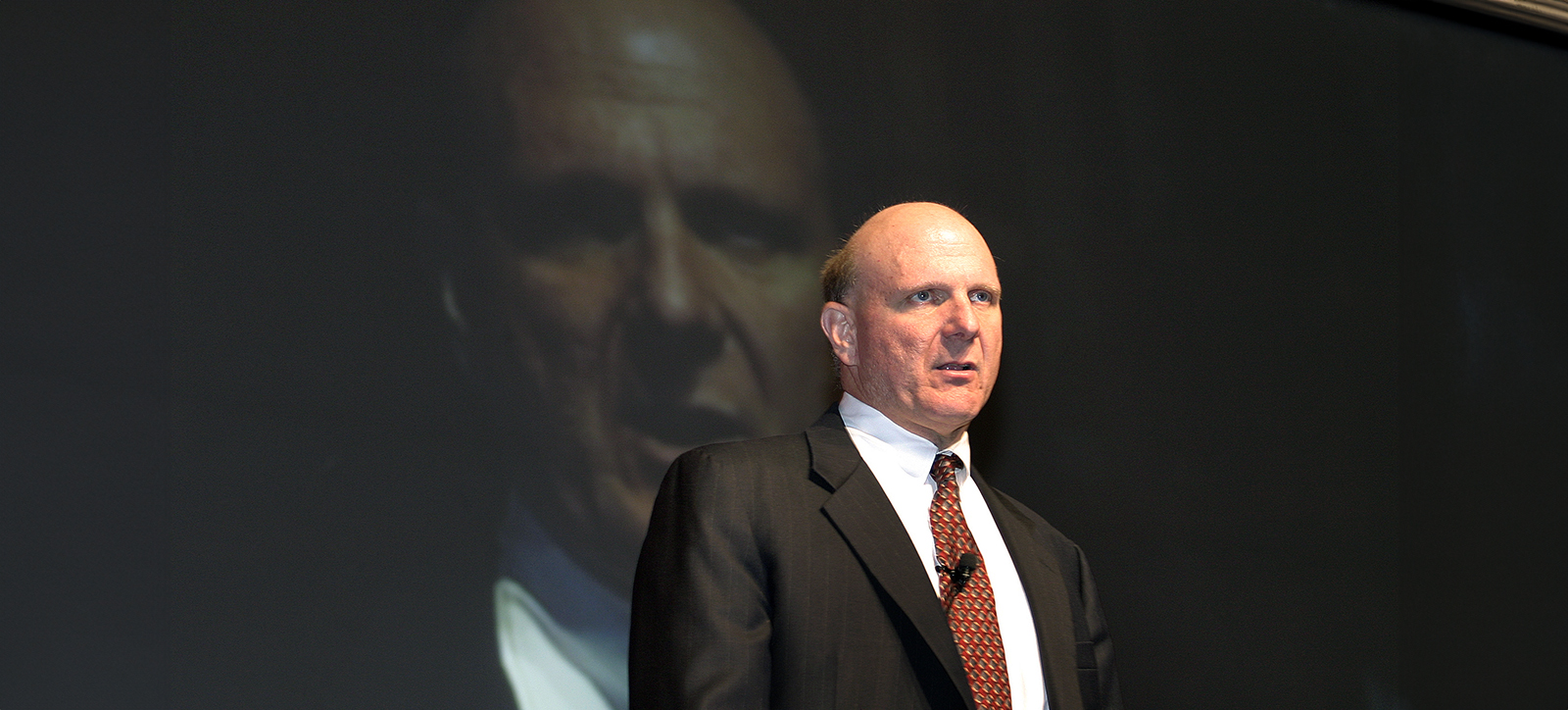

Prepare to fail: It took Microsoft six months to replace Steve Ballmer because they had no CEO succession plan

Microsoft may well be one of the world’s biggest tech firms, but it still failed to have a plan in place when Steve Ballmer abruptly announced he would be stepping down as CEO in 2013.

It took six months of uncertainty and a search that took in more than 100 candidates to come full circle and appoint insider Satya Nadella to be Microsoft’s third chief executive.

And Microsoft is not alone in not having a CEO succession plan. A 2014 survey by the National Association of Company Directors found that most public companies had no formal CEO succession process and only 17 per cent of firms were judged by their directors to be effective at succession planning.

Yet, losing a CEO without a clear plan for their replacement can usher in a period of uncertainty and apprehension about a company’s future performance and even viability.

Investors, markets, ratings agencies, regulators, and lenders all now expect to see evidence that boards of directors regularly discuss CEO succession planning, and ideally have taken steps to ensure they would be able to react should change be needed.

Often this can be viewed as a difficult discussion to have around an existing CEO, or it may simply be that boards feel disclosing their CEO transition plans in public filings limits their flexibility as they will be bound by such plans in the future.

With my colleagues Dragana Cvijanovic, of Cornell University, and Rachel Li, of the Securities and Exchange Commission (SEC), we researched how succession planning affects a company’s performance and found five reasons why it should be firmly on the agenda of every organisation.

1 It makes it easier to remove an underperforming CEO

Businesses that have a clear plan about how they would replace a CEO will be in a better position to remove an executive if such a course of action becomes necessary.

Indeed, we found that firms with succession plans in place have a 6.6 per cent lower probability of being forced to fire a CEO, and thus, are less likely to experience the cost and uncertainty that comes with such a sudden departure.

Those companies with a succession plan are also better at disposing of underperforming CEOs. We found they had a higher turnover-performance sensitivity throughout the period we studied compared to firms with no plans – ie directors at firms with a succession plan were more attuned to spotting poor performance and swiftly replacing a sub-standard CEO.

Through the succession planning process, firms improve the availability and quality of performance metrics. By disclosing what sort of performance metrics they want from the CEO role in their public submissions to the regulator, they also detail how they will judge their incumbent and so are ready to dispose of executives that don’t hit their targets.

2 A smoother transition when the CEO does go

If there is one thing investors don’t like, it is uncertainty. An unexpected departure – and the revelation that the business had no established succession plan – means investors, ratings agencies and other stakeholders cannot make an informed assessment of the prospects of a business.

Letting the markets and other interested parties know there is a long term plan in place can help calm any nerves. By feeding investors information on succession plans through proxy filings, such as setting out the training and mentoring of internal candidates or detailing how they find potential external candidates, companies are ensuring a smoother transition.

A good example is pharmaceutical multinational Pfizer, which has been disclosing its succession planning procedures since 1998 and followed them in its 2006 deliberations on a successor to its then CEO Hank McKinnell.

By disclosing a succession plan, a firm will put its stakeholders at ease that its board is well prepared and has established policies and procedures to follow in the event of a CEO departure. Such preparedness reduces investors’ apprehension and is viewed positively by ratings agencies and regulators.

Succession planning leads to a lot less short-term volatility in a company’s stock price around the announcement of a change of CEO, with our research finding the share price remains significantly less volatile over the first year of the new CEO’s tenure.

3 A planned approach is likely to lead to a better fit

Our research found that those CEOs who are appointed because of a clear succession plan are more likely to stay for longer.

A longer tenure is likely to stem from ensuring a close match between the characteristics required by the business and the attributes possessed by the incoming CEO. Thus, we can interpret a longer tenure as a measure of success because any poorly matched CEO would tend to be dismissed or leave of their own accord.

This is a direct result of having given sufficient thought to the type of person required before the need to appoint someone arises. In this way, a succession plan helps not only to make the right appointment but also choose the timing of the outgoing CEO’s departure, should it be known that the incumbent is not performing.

Not only does a planned succession mean more thought is given to the type of person required, it also makes businesses more willing to work with those executives on an ongoing basis to ensure they have the best chance of success.

Businesses that know the qualities of an incoming CEO and have the support of investors and other stakeholders will provide timely feedback to CEOs once in position and help them to achieve their goals.

4 Less likely to appoint an interim CEO

By turning to an interim CEO organisations may be guaranteeing themselves a prolonged period of uncertainty.

For outside investors this can also be taken as a sign that the business was unprepared for the departure of the outgoing CEO, which can lead to doubts and concerns that will be reflected in the share price for listed companies.

Having a clear process that would kick-in should a CEO leave or need to be replaced can help to allay these concerns and remove the need for an interim as a temporary measure, minimising any disruption to the firm’s management.

We found that firms with succession plans are around seven per cent less likely to choose an interim CEO.

5 It can help retain other senior positions

Dismissing a CEO naturally creates anxiety and mistrust within his or her own management team, but having a clear plan in place will make it less likely that other executives will also leave with the CEO, reducing the risk of a big gap in management.

Letting key people know how the business will respond and the type of incoming CEO the firm is looking for will help provide reassurance. This will keep non-CEO management churn to a minimum.

Further reading:

Cvijanovi, D., Gantchev, N. and Li, R. 2022, CEO succession roulette. Management Science.

Nickolay Gantchev is Professor of Finance and teaches Financial Management on the Executive MBA, Executive MBA (London), and Full-time MBA.

Learn more about leadership on the four-day Executive Education course The Strategic Mindset of Leadership at WBS London at The Shard.

For more articles on Leadership and Finance and Markets sign up to Core Insights here.

X

X Facebook

Facebook LinkedIn

LinkedIn YouTube

YouTube Instagram

Instagram Tiktok

Tiktok