M&A mystery: Unexpected benefits are often missed in tech takeovers and only a proper process will capture them

Mergers and acquisitions can be fraught and messy, and never more so than when firms are buying technology companies.

Indeed, the tech sector’s share of the total value of mergers and acquisitions (M&A) globally has increased year-on-year since 2017, reaching 22.2 per cent in 2022, according to financial data analysts Pitchbook.

But amid the flurry of M&A activity to integrate a new tech business smoothly, are acquiring companies missing out on opportunities they didn’t even know were there for the taking?

My research has revealed how firms can exploit unforeseen and unexpected benefits when they buy a tech business, even if it’s not clear in advance what these might be.

Why is technology M&A different?

Usually when a firm gets involved in technology M&A, the idea is not to consolidate market share or reduce cost structures, but to take advantage of possibilities offered by a new technology.

It’s faster to buy expertise and innovation than it is to develop it in-house. It is a way for companies to renew and reshape themselves, and to offer more capability to their clients.

While for the acquired tech firm, the takeover might allow them to leverage a large sales channel or to offer a more complete solution to their customers.

Frequently the acquirer wants the new company to help them grow and often to transform their legacy business with more tech-focused product lines.

But tech deals often fail to produce the intended synergies, and acquirers of technology are trying to learn how to improve a poor track record.

After in-depth interviews with more than 80 staff involved in multiple integrations of niche tech companies by large serial acquirers, I have identified clear methods to take advantage of unplanned synergies from a new team and business.

From real experiences, we see that when integration teams follow these processes – alongside all the usual steps – companies can identify, assess, prioritise and ultimately build upon the intended value of the deal.

1 Integration teams need an open mind

No acquisitions take place in a perfect world where everyone involved shares the same vision and goal.

Once a deal is done, integrations take energy and skill, with time-pressed teams juggling many demands.

Integration teams must, of course, focus on the intended goals that drove the deal, and everyone must be clear what these are. Without this clarity from the leadership through to workers throughout the organisation an acquisition could fail to bear fruit.

Without ever losing sight of these goals, the integration project teams can also embark upon a structured journey of discovery to seek out unplanned synergies.

If they are open to expanding their thinking to include these possibilities it’s far more likely they’ll capture any unseen benefits during the post-merger integration (PMI).

2 Use a process to explore the possibilities

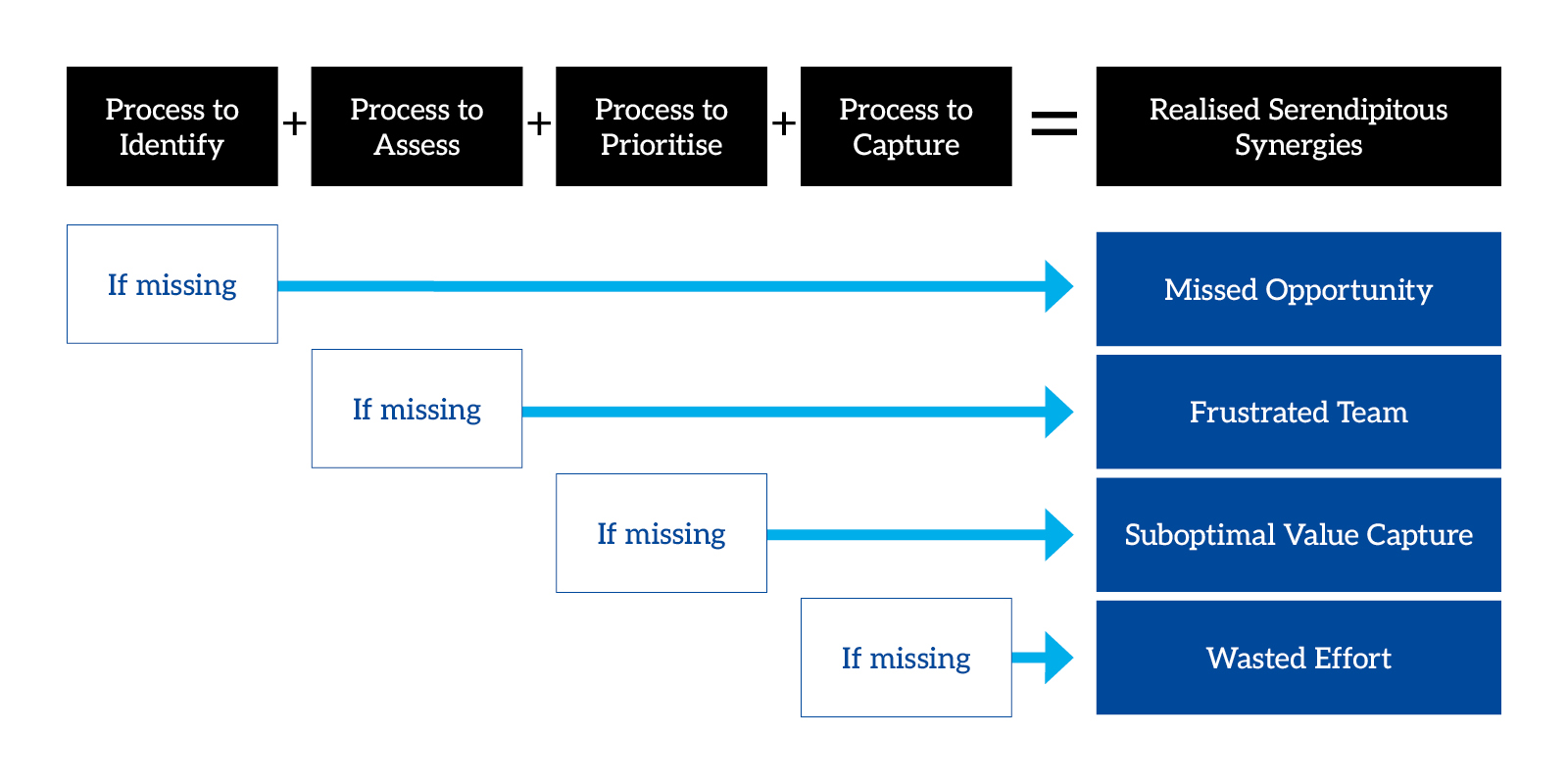

Incremental gains of an acquisition, large and small, are for the integration team and management to identify and explore via the following linked, but separate stages:

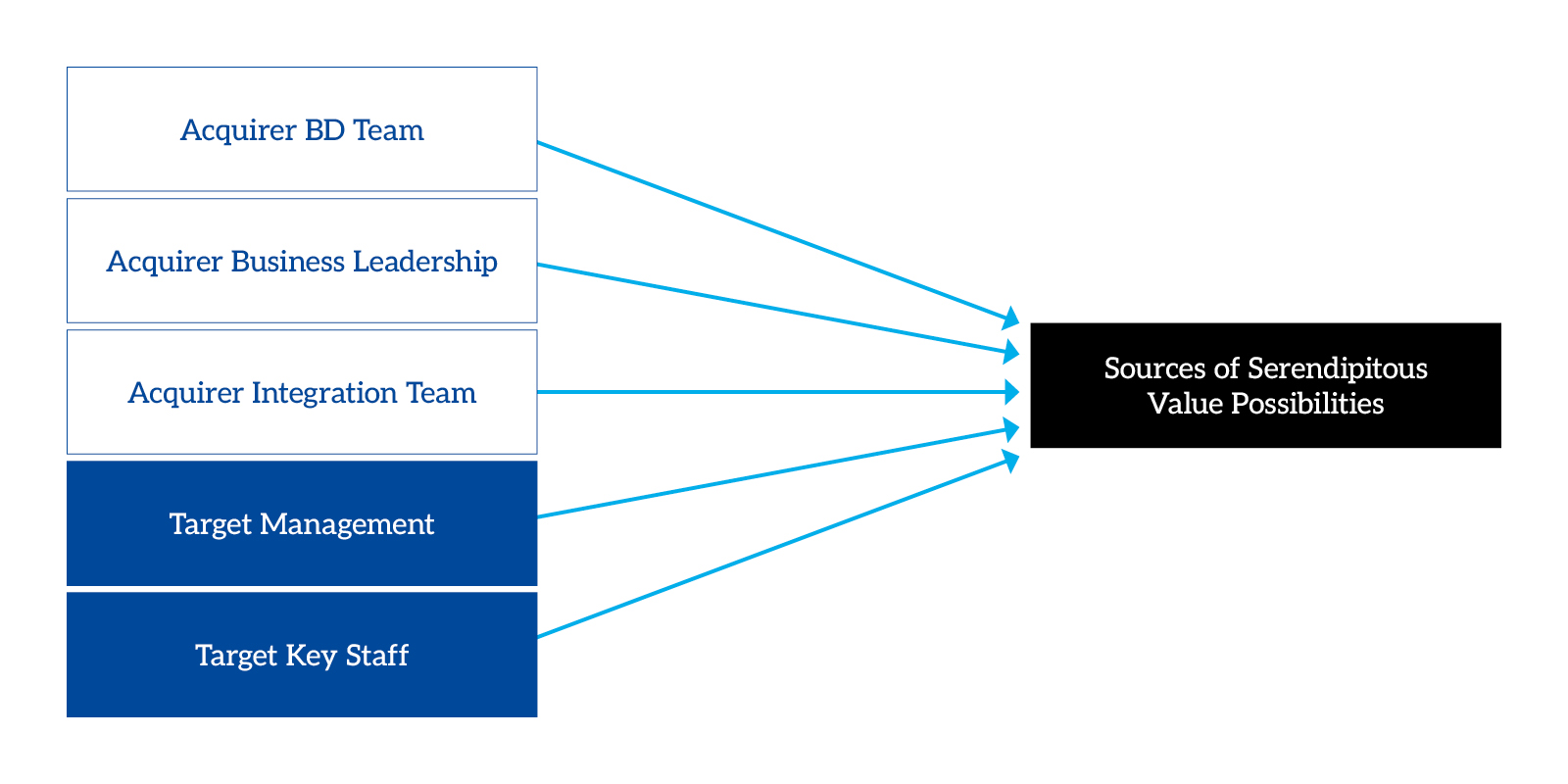

- Identify individuals within the new tech acquisition who know where value lies – integration teams that incorporate colleagues from both the acquirer and the target business are more effective at identifying unexpected benefits from the deal.

- Canvass and gather as many insights as possible from as many different people – staff, clients, suppliers – about potential gains. Think of this as the start of a funnel of ideas that otherwise might be unheard. Ideas come from many places – from leadership and business development teams within the acquiring company, as well as the integration team. But they also come from the leaders and staff of the target company – hunting them down will reap rewards.

- Make a practical assessment of which ideas might be most effective and achievable – both with the acquired team and business and with the acquirer.

- After this joint assessment, teams must prioritise the most worthwhile and viable initiatives that will reap unexpected rewards and slot them in between the other essential priorities during integration.

- Once the unexpected opportunities have been prioritised, teams must define the process they will use to capture their value.

3 Use the experiences of those who’ve been involved in the deal

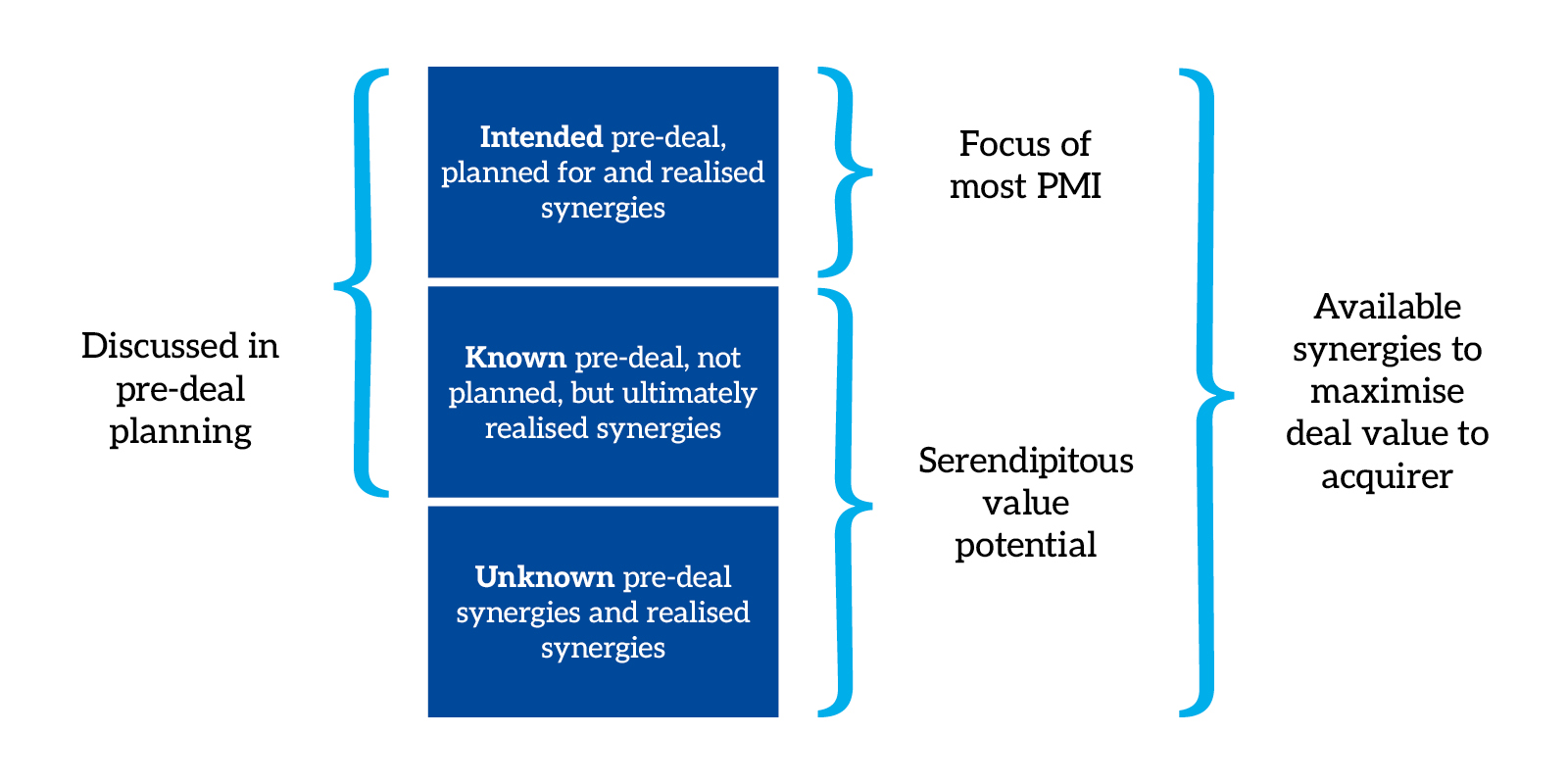

My research showed that many potential benefits were often brainstormed pre-deal, but those that were not essential for the deal’s approval tended to fall by the wayside.

Yet many of those ideas could bring value during integration. Be sure to return to all the involved team members – including pre-deal teams, deal teams, and the PMI team – to collect their ideas.

4 Look outside the organisation to find more possibilities

A whole host of unplanned and ‘out of the box’ ideas came from many different places – including the market itself.

A recurring theme emerged in my research – integration teams were able to build stronger relationships with customers of the acquired firm to identify unexpected opportunities. All businesses engaged with customers as part of their integration, but some were able to use those interactions to enhance the value of the deal.

Suppliers, distributors and other external organisations also had ideas on how to help deliver value to the acquirer from their perspectives. Those firms that took the time to explore these did indeed find value.

“Building relationships was essential…our integration team was encouraged to be curious,” one executive told us of a new tech acquisition. “We took steps to build bridges between our team and the many involved stakeholders. Our team very much wanted to learn how [the new acquisition] operated with an eye to further improvements down the road.”

5 Delve deep into the acquired organisation

Behind good technology lies a great team.

“If you are buying tech you need the people who built it, and it will be much harder to generate value without them,” one interviewee at a large firm told us.

How staff within the acquired business feel about their new owners matters – do they feel at odds with the new culture? Do they feel understood, valued, engaged? Can they still be creative? The mood is set not only by managers but by key employees.

A buyer wants to bring the energy, excitement and skills of the smaller company on board – failing to do this might prompt an employee exodus and at the very least fritter away precious insights.

How could acquirers know, for instance, that an unseen employee is brimming with good ideas? If there’s no process to find them and evaluate their input then insights will be wasted.

By giving staff from the acquired firm a safe space to discuss the integration and by challenging them, teams can uncover potential that otherwise might be missed.

Joint projects with shared aims to explore ideas are an effective way to get staff of the new and acquiring company to work together – and this collaboration brings unexpected advantages.

My work showed that these shared goals were often to be found in businesses which were sensitive to new employees’ feelings.

6 Pace - integrate fast or go slow and don’t break anything?

The pace of integration will depend, as my research shows, on the type of deal.

I found it helps to see integration as three parallel activities, each of which must be done at an appropriate pace.

Finding the right timeline for each – which can vary significantly – led to increased value and enabled teams to spot and realise unexpected gains. The three parallel integration activities are:

- Basic functions such as email, HR, payroll – implement swiftly; there are few chances here for making bonus returns.

- Commercial processes like articulating customer value, roadmaps for customer change, client value/contract expansion – these should start immediately and be ongoing; there is potential here for unplanned gains.

- Technology products involve a longer process which, if given space, can yield unexpected benefits.

Not rushing integration of the technology products, but instead gradually phasing them in, will help keep staff onside.

And treating the acquired company as an alliance, giving it a transitional identity and protecting it with a temporary wall can ease the journey and contribute to unforeseen benefits.

Identifying and capturing the unexpected benefits during the integration of a new business just isn’t a priority for acquiring firms, my research shows.

But for integration teams who took the time to search it out, there were rich rewards.

A combination of formal methods, a concerted effort to engage with everybody affected, expanded thinking and accommodation of employees’ mixed feelings all help uncover these new and unexpected gains.

Greg Schlimm is on the Research Faculty at the Transaction Advisors Institute and did this research as part of his Doctorate of Business Administration DBA.

Learn more about M&A and strategy on the four-day Executive Education course Strategic Choices at WBS London at The Shard.

For more articles on Strategy and Organisational Change sign up to Core Insights here.

X

X Facebook

Facebook LinkedIn

LinkedIn YouTube

YouTube Instagram

Instagram Tiktok

Tiktok